Chapters

- Back to Top

- I. Anarchic Urbanization and the Housing...I. Anarchic Urbanization and the Housing Crisis in Marrakech

- The Heterogeneity of Housing TypesThe Heterogeneity of Housing Types

- The Absence of Planning and Urban Contro...The Absence of Planning and Urban Controls

- The Housing Crisis in General and of Pub...The Housing Crisis in General and of Public Housing in Particular

- II. Morocco's Housing Crisis and the Gov...II. Morocco's Housing Crisis and the Government's Response to It

- The Project to Build 200,000 HomesThe Project to Build 200,000 Homes

- The Limitations of the Project to Build ...The Limitations of the Project to Build 200,000 Homes

- The Government's Activities in Marrakech...The Government's Activities in Marrakech and Their Impact

- ERAC-Tensift, the Leading Building Devel...ERAC-Tensift, the Leading Building Developer in Marrakech

- A Supply That Does Not Meet DemandA Supply That Does Not Meet Demand

- ConclusionConclusion

- References

Housing in Marrakech: The Contradictions of Public Interventions

The cities of Morocco have endured tremendous pressure due to demographic growth and rural exodus. Between 1960 and 1994, the Kingdom of Morocco's annual rate of population growth was 3.5 percent. Its urban populations grew by 5.9 percent.

This pressure has meant an urban housing deficit, officially estimated at over 700,000 units.

The housing crisis in the city of Marrakech is particularly acute. Demand greatly surpasses supply. As a response to this crisis, the national campaign to provide 200,000 homes (about 4,700 of which are located in Marrakech) has done nothing to remedy the city's anarchic urbanization. (See section I.)

Although the housing crisis in Morocco is a structural problem, the response of public authorities has only accentuated the country's inequalities and dysfunctions. (See section II.) In Marrakech, the official production of housing continues to be dominated by essentially one actor, ERAC-Tensift, the state land developer and property agent.1 Because it lacks coordination, however, the state's activities have neglected several dimensions of the problem, notably the question of how to finance housing. However, creative responses to the problem (though rarely officially recognized) have been devised by the population. (See section III.)

With the establishment of the French protectorate in 1912, the urban tissue of Marrakech began to undergo profound transformations. These can be summarized as follows:

First, the rending of the urban fabric with the creation of the European city, which would later become Marrakech's principal business center. The willingness of planners to intervene in the city's urban fabric was an expression of General Lyautey's desire to separate the medina — the core of Marrakech — from the modern city. This policy was intended not only to preserve the identities of the so-called autochthons who lived there but also to show the "civilizational superiority" of European Christian society over Muslim society.2 As Abderrahmane Rachik has rightly pointed out,

the urban planning recommended by "Lyautey" was based on the sort of relatively precise social project that occasionally takes on the allure of utopian ideology. If Lyautey considered this policy a way of respecting the customs of "indigenous peoples," objectively such a social practice is founded on preoccupations with hygiene, on feelings of fear and disdain with regard to the "indigenous," and consequently on a profound wish to regroup this "dangerous" population (hygienically speaking) and to distance it spatially from the city reserved for Europeans, in order to assure ease of control.3

On the other hand, the authorities of the French protectorate also created the industrial quarter, which would contain factories for processing the region's agricultural production.4

Second, the "informal" work sector5 has exploded, and the unemployment rate is particularly high, both a consequence of the lack of industrialization in the urban economy, which continues to be dominated by artisan, commercial, and a handful of food- and agriculture-related industries. The city's economic fabric today has seen no important developments when compared to that of the past (with the exception, perhaps, of the leisure and tourism industry).

Third, poverty has spread,6 accompanied by a notable spatial marginalization marked by strong segregation. This is exemplified by the "slumification" of the medina and the proliferation of unhealthy douars (villages), which coexist with luxurious properties and villas (each of which extends over many hectares within the urban perimeter). The Tensift region (of which Marrakech represents 70 percent of the urban population) is the second poorest of the Kingdom's seven regions.7 A few statistics confirm this situation:

• School-age children in Marrakech are less educated than the national average.

• The rate of child labor is highest in Marrakech, as is the number of single women.

• The total rate of employment is higher (since the poor are often obliged to hold down at least two jobs in order to survive).

Fourth, Marrakech has experienced a relatively modest rate of demographic growth compared to that of cities along the coast, but in keeping with the city's horizontal extension (as exemplified in ERAC-Tensift's new public housing developments such as those in Massira I, II, II, Laskar douar, etc.). Between the two census periods (1960-71 and 1971-82), the city's rate of annual growth went from 2.9 to 2.6 percent, while that of similar cities was on average 4 percent and 3.3 percent for the two periods respectively. Between 1982 and 1994, the city welcomed 232,778 new residents, that is, an average of 19,398 new residents per year, which is equivalent to 3,966 households.8

I. Anarchic Urbanization and the Housing Crisis in Marrakech

Because it lacks an industrial complex, which would promote progress and enrich both the population and the city, Marrakech is prone to suffer the vicissitudes affecting the hinterland (where, depending on the land's aridity, the pastoral and agrarian systems often experience sub-productivity). The result of this is an anarchic and unstructured urbanism, of which the primary manifestations are:

• Heterogeneous housing types.

• The absence of planning and urban controls (and, consequently, a high degree of urban speculation and lack of respect for the environment, among other things).

• A housing crisis in general and a social housing crisis in particular, to which public authorities have not responded adequately.

The Heterogeneity of Housing Types

As previous scholarship has stressed, the urban fabric of Marrakech is characterized by heterogeneity and diversity. Ahmed Bellaoui notes that:

Marrakech thus represents the type of city in which general evolution is far from being linear and for which a prestigious past symbolized by a coherent and uniform Medina flagrantly contradicts that of its present, which is characterized, among other things, by the overly heterogeneous urban landscape. Far from constituting an element of grandeur, and by consequence, of dynamism, the medina could be seen as constituting, along with the peripheral douars [villages], the source of nearly all the problems that today are causing the greatest and the most prestigious of Morocco's cities to suffer.9

The city is structured by four types of housing:

• The historic medina, made up of houses with patios, apparently without a high degree of social segregation.10

• The new city, Guéliz, made up of sub-areas with diversified functions (zones for commerce and service, an industrial zone, a residential and hotel zone, and so forth).

• The state's private developments. Due to the medina's high density and degree of "ruralization," the public authorities have launched campaigns for development and inexpensive housing, as well as to improve sanitation networks and provide resettlement lots (Unit III), new neighborhoods for auto-construction (built by the residents themselves) (Massira I, II, II, Asli, etc.), and, lastly, the buildings that are part of the national project to construct 200,000 homes.

• Spontaneous urban douars.11 According to the most recent census of makeshift habitats (1998), 156 douars were noted in Marrakech's urban community, compared to a mere 61 in 1991. This represents some 150,000 persons, or 22 percent of the total population of the greater urban agglomeration.12

The Absence of Planning and Urban Controls

The proliferation of unsanitary housing conditions alone would suffice to demonstrate the weakness of city planning in Marrakech. This failure is even more puzzling when one takes into account the fact that the city's property structure is characterized by a predominance of private estates (35 percent of the total). But the availability of considerable numbers of private estates only weakly favors urban planning, for the following reasons: first, the existence of several constraints (non aedificandi [nonbuilding] zones and non altius-tollendi [nonremoval] zones), and second, an insufficient number of zones open to urbanization (such as Méchouar and the Kasbah).

Instead of urban planning, it might be said that there are presently only urban renovations.13 Indeed, a proper urban policy would have to be based on the resolution of several problems.14 For instance, such a policy would have to presume the existence of particular goals and means.15 It would have to resolve the conflicts residing at the heart of the principal entity that implements it, namely, the central state. As it happens, this entity pursues several policies rather than a single policy, and these vary according to political, geographic, historical, and a variety of other circumstances. It would have to presume the existence of a convergence between global planning (the allocation of resources) and urban planning (the allocation of space),16 as well as between the state and the region (decentralization), and the state and the private sector (a system of contracts).

In regard to the latter, the SDAU of Marrakech (Directive Plan for Urban Development) notes that "the voluntary activity of the large public developers — for whom the choice of sites is determined more by real estate opportunities than by the desire to occupy the site in a harmonious way — risks in the short term derailing the natural system of extension of the urbanized zone. Already, the strong westward push of the district of Massira has created elements that strain the fabric."17

The Housing Crisis in General and of Public Housing in Particular

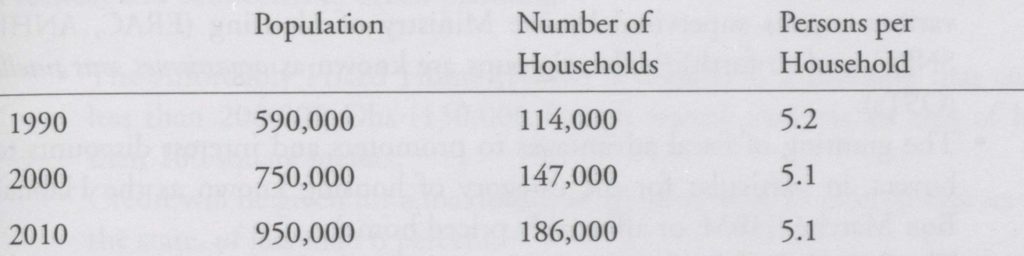

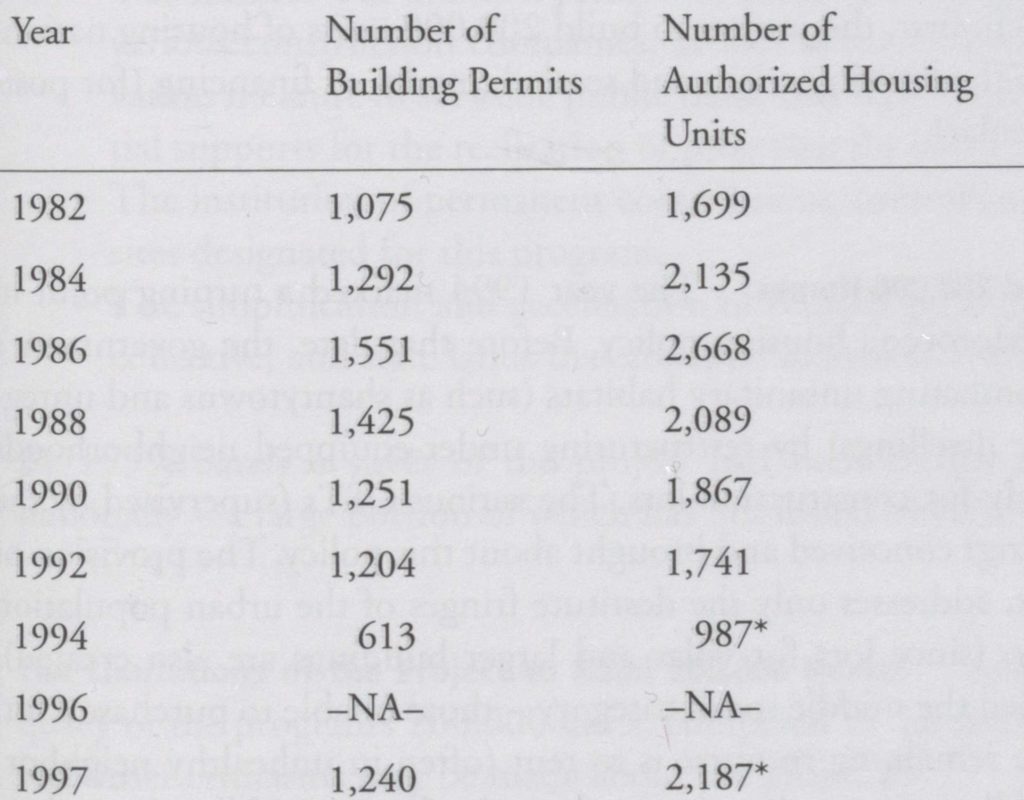

Table 1 gives the SDAU's projections of the estimated number of households in Marrakech in 2010, based on an average household size of 5.5 persons between the years 1982 and 1990, 5.2 between the years 1990 and 2000, and 5.1 since 2000.18 If we were to hypothesize a zero deficit of housing, 3,800 new homes would need to be built each year until 2010. As for actual supply, Table 2 gives an idea of the progress of authorized housing units in Marrakech.19 The comparison between the level of housing need and number of officially authorized constructions shows a considerable deficit, close to 50 percent (at least for the years in which the production of housing units is considerable, in this case, 1997).20 How, then, have the public authorities responded in order to meet these enormous needs?

Table 1. Projected Growth of Households

Table 2. Growth of Authorized Housing Units in Marrakech

II. Morocco's Housing Crisis and the Government's Response to It

Schematically, the action of the state takes several forms:

• The creation of laws and ordinances concerning urban development.

• Property development in the urban area.

• The reduction of unhealthy housing conditions.

• The production of social housing, notably through the national project to construct 200,000 homes. For the most part, this has been undertaken by various organs supervised by the Ministry of Housing (ERAC, ANHI, SNEC, and so forth).21 These groups are known as organismes sous tutelle (OSTs).

• The granting of fiscal advantages to promoters and interest discounts to buyers, in particular for the category of housing known as the Habitat Bon Marché (HBM, or affordably priced home).

• The financing of development and acquisition by banks with a majority of public capital, such as the Credit Immobilier et Hôtelier (CIH) and the Banque Central Populaire (BCP).

It is, therefore, a multidimensional policy: statutory, institutional, and financial, among other things. Here I will focus on two areas of the government's housing policy in Marrakech: first, the project to build 200,000 units of housing nationally in response to the housing crisis, and second, modes of financing (for postfinancing in particular).

The Project to Build 200,000 Homes

The year 1994 marked a turning point in the Kingdom of Morocco's housing policy. Before that date, the government's policy aimed at combating unsanitary habitats (such as shantytowns and unregistered/clandestine dwellings) by restructuring under-equipped neighborhoods and providing ready-for-construction lots. The various OSTs (supervised by the Ministry of Housing) conceived and brought about this policy. The provision of such lots, however, addresses only the destitute fringes of the urban population and the well-to-do (since lots for villas and larger buildings are also created). This policy excluded the middle social category — those unable to purchase a lot, for whom the sole remaining recourse is to rent (often in unhealthy neighborhoods). This middle-income class (or, rather, the lower middle class, since income levels do not exceed 3,600 dirhams a month) thus had very real needs. The royal speech of March 3, 1994 recommended the construction, with considerable support from the state and on very advantageous conditions, of a first program of 200,000 homes destined for this population.22 The measures taken to bring about this project were financial, fiscal, landrelated, and connected to urban planning:

• The Affordably Priced Home (HBM) is defined as a dwelling that costs less than 200,000 Dhs (150,000 French francs) and has an area of less than 100 square meters.

• Credit will be given for a maximum of 25 years with an interest rate set by the state, of less than 6 percent.23

• Duties and taxes affecting the HBM are waived.

• Rights and taxes related to property taxes, building rights, permission to create lots, the intervention of agencies, of the National Office of Electricity (ONE), and the National Office of Potable Water (ONEP) are reduced.

• The creation of a mortgage market (May 2000).24

• The transfer — at nominal prices — of lands from the public land reserve to various construction companies, as well as the establishment of a conservation measure to set aside public lands that have been identified as potential supports for the realization of programs for social housing.

• The institution of permanent commissions, central and local, to select the sites designated for this program.

• The simplification and acceleration of transfer procedures for communal, collective, and state lands that are open to urbanization.

By 1999, barely a sliver of the project had been carried out — 48,000 units nationally — a large portion of which has not found buyers.25

The Limitations of the Project to Build 200,000 Homes

Apart from the inadequacy of the program's 200,000 units, compared to the size of the demand, several other criticisms may be made about the project:26

• In terms of needs, the program essentially targets only public and para-public employees.

• In terms of choice of residence, it offers the same solution and perpetuates only minimally differentiated choices.

• In terms of methods of financing, it maintains the existing system of rebates, which is very costly for the state's budget and is hardly an effective means of encouraging access to the properties.

• In terms of reforming the system of financing, it makes no contribution to improving the system but in fact worsens the administrated mobilization of resources27 to the advantage of the bank (CIH). This reinforces the latter's monopoly and prevents the emergence of competition, which would enable the cost of credit to be lowered and expand the accessibility of credit.

• In terms of production, the program increases the role of the developers of social housing, without, however, providing an adequate solution for the housing sector.28

To conclude, the project to build 200,000 homes has exposed all the incongruities of the system for financing housing in Morocco. It is characterized by a condition of near-monopoly, in which a sole lending institution (the CIH)29 provides close to 75 percent of the credit.30 A discriminatory legal and legislative environment, long-standing privileges granted to the CIH,31 and credit practices based on rationed resources (such as differentiated rates of interest) are the factors that permit this situation to be maintained. As a result, the conditions acquiring credit are very restrictive, access to credit for housing is discriminatory, and the fixed price of these credits generates a uselessly high profitability (with the exception of recent years).32

For Marrakech, the state acts directly through the construction of about 4,700 housing units within the framework of the national program for 200,000 homes.

The Government's Activities in Marrakech and Their Impact

Real estate development in the city of Marrakech is dominated by the activities of the OSTs such as ERAC-Tensift. The latter assigns the roles of the various players in the overall real estate development scheme. It is difficult to ascertain the exact position of the OSTs in the development process. Private building promotion is still largely unstructured and has far less breadth, although a number of groups (Chaâbi and Chkili, for example) are gaining a foothold. Furthermore, the social housing sector, long ignored by private promoters, is beginning to interest them, especially with the fiscal advantages now being granted through the launch of the 200,000-unit campaign. One should, in fact, distinguish between two types of building promotion, both of which are dominated by public actors:

• Land development, which generally has involved small areas and has mobilized few financial means. Though OSTs are largely dominant in this segment, the private sector has also been active in it for some time, through the realization of lots for the construction of both inexpensive and luxury housing.

• Building development (the construction and sale of housing units), which, properly speaking, is the exclusive domain of the OSTs in general and of ERAC-Tensift in particular. These entities carry out the large projects while private building developers specialize in small ones (those with a few dozen units).

It must be emphasized that auto-construction (that is, people building their own homes) is extremely pronounced and meets more than three-quarters of the need for housing in the city. This route is symptomatic of the nonindustrial character of the production of housing in Marrakech.

For the most part, building development is therefore dominated by the OSTs, and by ERAC-Tensift in particular.

ERAC-Tensift, the Leading Building Developer in Marrakech

By the end of 1998, ERAC-Tensift had completed a total of 16,042 homes, 43,029 lots, 3,538 businesses, 76 offices, and 5,937 transfers to new housing. From this we can infer a total of some 130,000 homes housing around 720,000 people, which is roughly equivalent to half of the region's urban population.33 Table 3 shows the accumulated physical achievements at the end of 1998.34

Table 3. ERAC-Tensift's Physical Achievements

ERAC-Tensift's activities are diverse, even heterogeneous. It fights unhealthy housing conditions, outfits industrial zones, and prepares transportation routes, among other things. This heterogeneity contributes to damaging its profitability, which is already in poor shape. This is also true for the other ERACs of the Kingdom.35

Because of its juridical nature (as a public establishment), because of the general context of the country's economy (the still strong presence of a state sector despite the fact that economic liberalism has been declared the strategy of choice), because of the fundamental nature of need — housing — to which it responds, and because of its position on the housing market (as dominant operator, especially for the national 200,000-unit project), ERAC is a "budgetivorous” operation. That is, its budget functions disproportionately. It concerns itself very little with market demand because the means of mobilizing funds to finance the project and the products it offers its clientele (the HBMs, or affordably priced homes, in particular) do not actually satisfy the clientele's needs. In 1997, ERAC's operational budget was 25.65 million Dhs for a turnover of 86 million Dhs, that is, about 29 percent. For 1999, this budget was estimated at 27.35 million Dhs for a team of 174 agents.

Several factors account for damage to the profitability of the investment:

• The reserve of federal lands is being exhausted. ERAC-Tensift is thus increasingly obliged to buy lands at market rates.

• Commercial competitiveness is weak. Stocks in late 1998 had a value of 1,730 million Dhs.

• Financial management is lax. ERAC-Tensift is overly indebted, particularly to CIH. At the end of 1998, its debt to CIH was 510 million Dhs, of which 150 million was due for payment.

• Negative profitability: in 1997, losses due to operational costs were close to 190 million Dhs.

• Of a total number of paid reimbursements concerning 45 loans for 683 million Dhs, ERAC paid 199 million Dhs in financial fees alone — an obvious sign of its disastrous financial management. These financial lees affect the cost of the dwelling and are consequently passed on to the buyers. In the opinion of the agency's director, "this situation may be explained on the one hand by the raised interest rate put into place by CIH, and on the other by the failure to pay back loans related to the entirely commercial operations.”36

It is, however, the project for 200,000 housing units that most clearly reveals the agency's structural difficulties.

A Supply That Does Not Meet Demand

The consideration of a triad of factors -district, type of housing, and mode of financing - enables an analysis of the disconnect between supply and demand for social housing:

The District. In Marrakech, the most important part of the government program to build 200,000 units was carried out by ERAC-Tensift in the district of HAM. This district consists of three sub-districts covering an area totaling 294 hectares:

• HAM I: 107 hectares, with a density of 3,060 lots: 1985

• HAM II: 92 hectares, with a density of 3,044 lots: 1986

• HAM III: 95 hectares, with a density of 2,241 lots: 1991

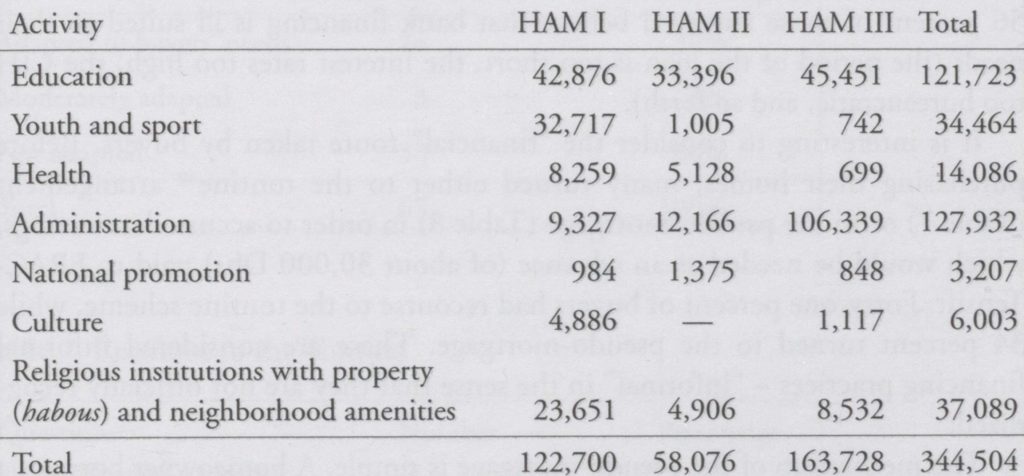

In terms of buildings, the area of HAM is divided into three zones: collective housing, low-priced individual housing, and residential housing (villas). Table 4 provides a projection of amenities required in the district of HAM. The surface areas reserved for necessary amenities were calculated based on national norms, although not all the amenities were carried out. However, Marrakech's portion of the national 200,000-unit campaign - almost entirely situated in the HAM district and covering a surface of 41 hectares built on unprepared land that lacked the required amenities (4,764 homes) - was incorporated "by force," one might say, in this space. It infringed vigorously on urban norms.37

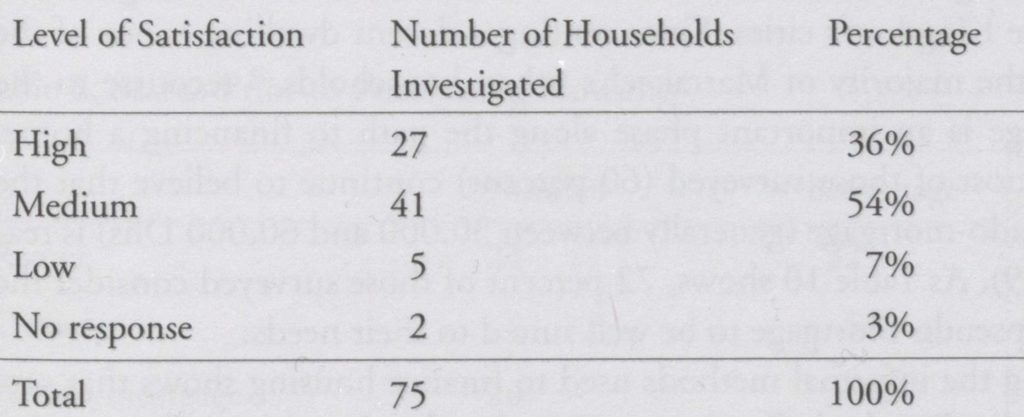

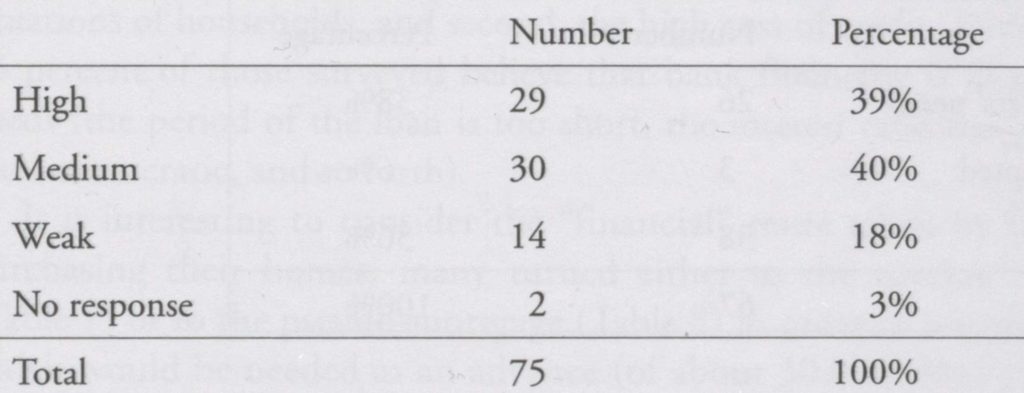

Furthermore, the amenities did not grow in response to the district's heightened population density.38 This is confirmed in our study of 75 households that were part of the program. Table 5 shows that the degree of satisfaction with HAM is medium (54 percent), due essentially to the lack of amenities and an unreasonably high number of annoyances. Considerable disparities exist within the district. The sub-district of HAM I (built in 1985) does not suffer so keen a lack of amenities as the sub-district of HAM III (currently under construction).

Financing. It must first be noted that the question of financing is of great importance, considering the nature of housing property, which cannot (or can only rarely) be paid for in cash. Rather, housing requires long-term loans. All participants in the 200,000-unit program have turned to financing through the CIH.39

Table 4. Surface Area of Amenities, Broken Down by Activity Type and Sub-District (Areas in m2)

Table 5. Level of Satisfaction in the District

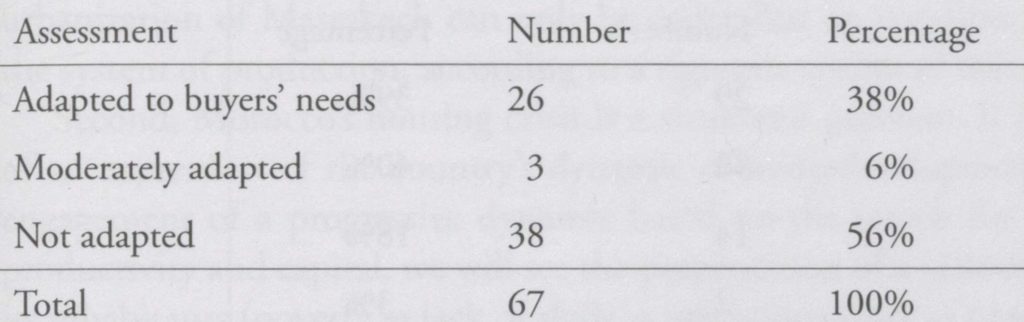

For those surveyed, the question of financing their homes was summed up in two problems: first, the inadequacy of bank financing in terms of the financial situations of households, and second, the high cost of credit. Table 6 shows that 56 percent of those surveyed believe that bank financing is ill suited to their needs (the period of the loan is too short, the interest rates too high, the CIH too bureaucratic, and so forth).

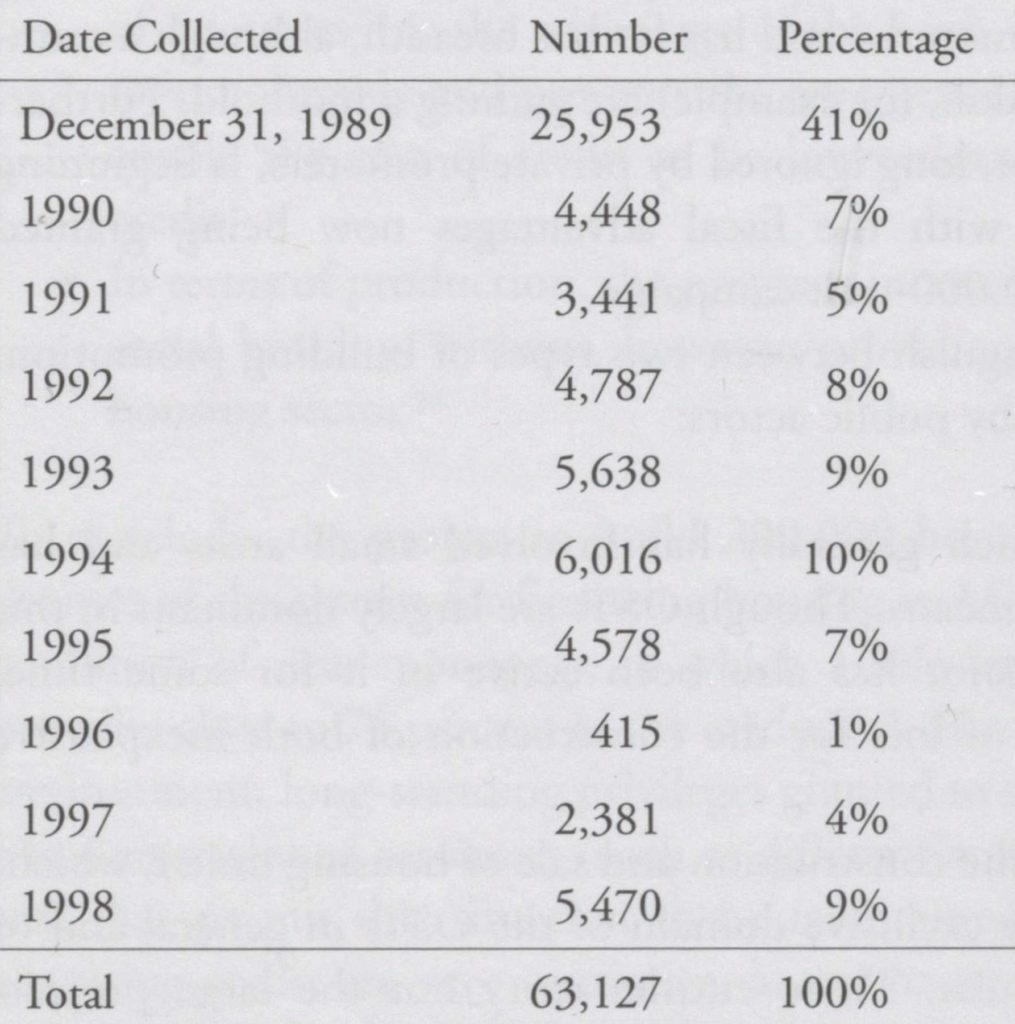

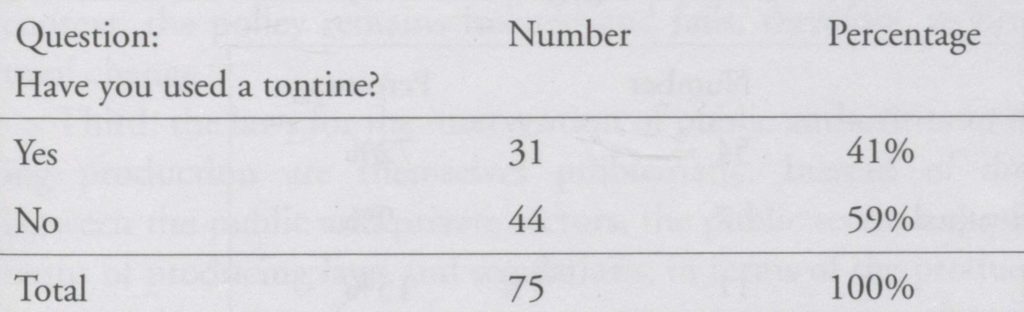

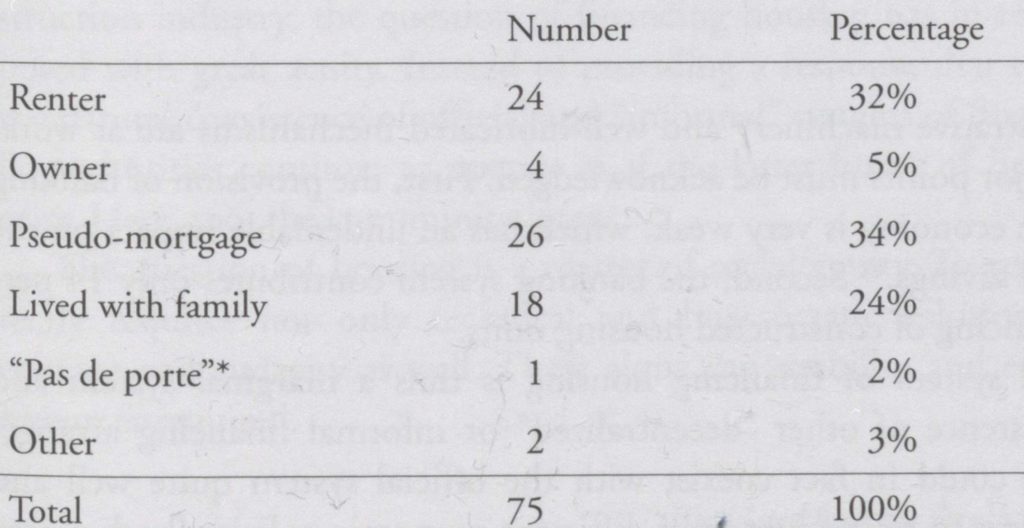

It is interesting to consider the "financial" route taken by buyers. Before purchasing their homes, many turned either to the tontine40 arrangement (Table 7) or to the pseudo-mortgage (Table 8) in order to accumulate savings, which would be needed as an advance (of about 30,000 Dhs) paid to ERAC-Tensift. Forty-one percent of buyers had recourse to the tontine scheme, while 34 percent turned to the pseudo-mortgage. These are considered informal financing practices — "informal" in the sense that they are not officially recognized.

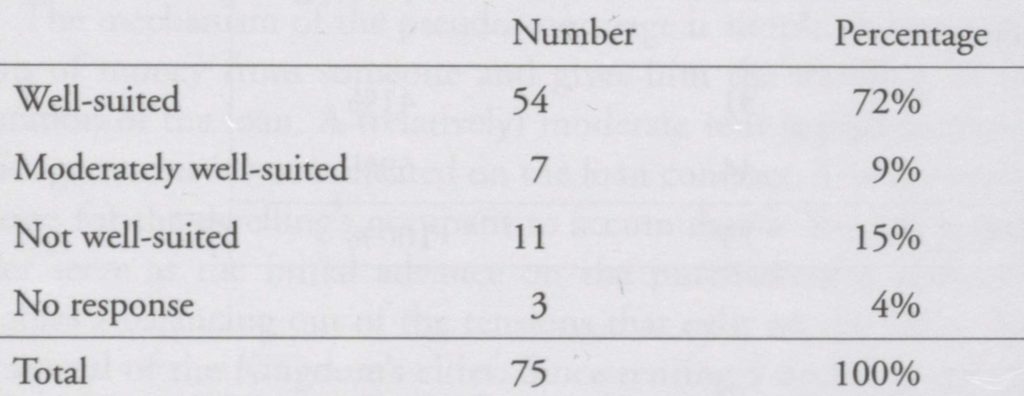

The mechanism of the pseudo-mortgage is simple. A homeowner borrows a sum of money from someone and gives him the dwelling as security for the duration of the loan. A (relatively) moderate rent is paid to the owner, though this agreement is not indicated on the loan contract. The pseudo-mortgage thus allows for the dwelling's occupant to accumulate a "forced" savings, which will later serve as the initial advance on the purchase of a home.41 The practice enables a balancing out of the tensions that exist on the urban housing market in several of the Kingdom's cities. Since renting a decent dwelling is out of the price range of the majority of Marrakech's urban households,42 recourse to the pseudo-mortgage is an important phase along the path to financing a home. Furthermore, most of those surveyed (60 percent) continue to believe that the level of the pseudo-mortgage (generally between 30,000 and 60,000 Dhs) is reasonable (Table 9). As Table 10 shows, 72 percent of those surveyed consider the practice of the pseudo-mortgage to be well suited to their needs.

Highlighting the informal methods used to finance housing shows that several modes coexist. Paradoxically, the practices that dominate the system are not officially recognized. The official system of housing in Morocco conceives of the country's economy as a smoothly working banking economy, one in which the

Table 6. Buyers' Assessment of Bank Financing

Table 7. Recourse to the Tontine

Table 8. Status Prior to Purchasing Housing

Source for Table 6 - 8: author's survey, March-April 2000

Table 9. Opinion about the Level of the Pseudo-Mortgage

Table 10. Assessment of the Pseudo-Mortgage's Suitability

correct administrative machinery and well-lubricated mechanisms are at work. In fact, two major points must be acknowledged. First, the provision of banking facilities for the economy is very weak, which has an undeniable impact on the mobilization of savings.43 Second, the banking system contributes only 14 percent of the financing of constructed housing units.

The official system of financing housing is thus a marginal system and ignores the existence of other "decentralized" or informal financing arrangements.44 These could in fact coexist with the official system quite well and might even help it to restructure itself. Efficient economic policies (both macro and micro) must take into account the articulation of various informal and formal circuits.

Conclusion

Several principles may be drawn from this investigation. First, the anarchic urbanization of Marrakech can only be controlled on condition that it acts on the system of production, according to a rigorous system of urban planning.

Second, Morocco's housing crisis is a structural problem. It is nothing short of an expression of the country's dynamic of underdevelopment. Without the engagement of a progressive dynamic based on the search for increased work productivity and capital, we will see the perpetuation of a vicious circle affecting its inhabitants (poverty —> lack of skills precarious work --> unsanitary housing - and back again to poverty). Even in the realm of housing production, the dominant process of auto-production remains archaic and fails to set a productive dynamic into motion. As far as the public authorities are concerned (in the project to build 200,000 homes), instead of placing the problem in its larger context, the policy remains isolated and fails, therefore, to bring about structural change.

Third, the laws for the intervention of public authorities in the area of housing production are themselves problematic. Instead of distributing tasks between the public and private sectors, the public sector enjoys hegemony — in terms of producing laws and regulations, in terms of the production of lots and housing, in terms of restructuring unsanitary spaces, and so on. As a result, there is confusion on the level of responsibilities and a harmful inefficiency in terms of interventions. All of this translates into added costs, waste of scarce resources, and a supply that fails to meet demand, among other things. Finally, in addition to the obstacle of real estate and the absence of a construction industry, the question of financing housing has in recent years been posed with great acuity. Instead of providing a response that takes account of the natural coexistence of official and "informal" systems of financing, the public authorities continue to operate as if the latter forms of financing did not exist. Here, too, the community loses. The question of housing is a matter of social equity. To respond to it correctly requires not only technical and bureaucratic solutions but political courage and audacity as well. These alone can mobilize and engage the social resources required.

Translated from the French by Miranda Robbins

References

1

ERAC-Tensift, the Etablissement Régional d'Aménagement et de Construction de la Région de Tensift (Regional Agency for Development and Construction for the Tensift Region) was created by Dahir Number 172-438 on May 21, 1974. This public agency is endowed with financial autonomy and placed under the supervision of the Ministry of Housing. Its activities concern the development and sale of construction lands and the sale of individual and collective housing for itself or on the part of a third party.

2

General Lyautey, the French colonial administrator in Morocco between 1912 and 1925, would see his ideas about planning in Moroccan cities expressed in the work of the great urbanist Henri Prost. The latter sought to apply the following principles to the work: (1) the creation of new cities alongside traditional ones; (2) the separation of these cities through the use of open space; and (3) the "preservation" of the traditional and original aspects of the existing urban fabric.

3

Abderrahmane Rachik, Ville et pouvoirs au Maroc (Casablanca: Éditions Afrique Orient, 1995), p. 27.

4

Paradoxically, the factories for processing agricultural products from the hinterland sparked a rural exodus and attracted a rural workforce to Marrakech. With this came the flourishing of makeshift residential quarters, many of them unsanitary.

5

According to recent estimates, informal employment represents some 60 percent of the total. For the least favored socio-professional categories, informal employment is even more important (approximately 90 percent for children). See "Diagnostic de la pauvreté urbaine à Marrakech," a document assembled by the PNUD/Ministry of Social Development, Solidarity, Employment, and Professional Training, March—August 1998, p. 10.

6

See Mohammed Gheris, "Espaces de la pauvreté et régulation étatique," paper presented at the Colloque International de Perpignan, France, October 20-22, 1999.

7

Per the old administrative division of the kingdom into seven regions, compared to the current provision of sixteen regions.

8

A comparison of the distribution of households according to the latest regional division (into sixteen regions) shows that in 1982, the region of Marrakech—Tensift—El Haouz represented 10.8 percent of total households, as compared to 10.2 percent in 1994. It thus holds the second highest number of households, after Casablanca (with 12.7 percent). In terms of urban households, out of a total of 2,519,685 households, the Marrakech—Tensift—El Haouz region has 177,753 households, or 7.05 percent. On the other hand, in 1994, 39.3 percent of this region's households were urban, compared to 29.2 percent in 1982. (Source: Department of Statistics.)

9

Ahmed Bellaoui, "Marrakech, des villes dans la ville," Atlas Marrakech, no. 2 (1994), p. 6.

10

Ibid.

11

The SDAU (Schéma Directeur d'Aménagement et d'Urbanisme) for Marrakech outlines three generations of spontaneous douars: the oldest (from the 1920s), which encircle the nouvelle vile (new city), with the exception of the neighborhood of Sidi Youssef Ben Ali (SYBA); the second generation (from the 1940s) along the industrial zone and the perimeter of the colonization to the west of the nouvelle ville; and the third generation (established after independence), which lies alongside and joins the Wadi Issil to the east and the Medina. The case of SYBA is an illustration. In 1955, this douar contained 2,821 unfinished houses and 1,768 completed ones, occupied by 2,013 foyers, that is, close to 10,000 people. In 1994, the population was estimated at 120,000. A decade ago, this district became a prefecture and has been able to benefit from important renovation work and beautification. For a complete historical analysis of the district, see M. de Leenheer, "Uhabitat precaire a Marrakech et dans la zone périphérique," Revue de Géographie du Maroc (Rabat) no. 17 (1970).

12

See M. Mouradi, "Les douars d'habitat insalubre à Marrakech," in Mémoire de D.E.S. en sciences économiques (Marrakech: Université Cadi Ayyad, 1998), p. 85. The author notes that from 1982 to 1998, the population of the douars had multiplied by 3.6, or from 42,000 to 150,000 inhabitants. This represents a growth rate of 8 percent.

13

See Mohammed Gheris, "État, marché et financement du logement au Maroc: Contradiction des interventions publiques," paper presented at the colloquium "Europe-Méditerranée, vers quel développement?" 14th Meeting of the Association Tiers Monde CRERI, Université de Toulon et du Var, Île de Bendor, May 27-29, 1998.

14

See Mohammed Naciri, "Les politiques urbaines au Maghreb et au Machrek," Round Table IRMAC+ERA 1036/VA/913 of the CNRS, University of Lyon, 1982.

15

It seems that the "absurd" question, What kind of housing do Moroccans want?, is still being posed within the ministry in Rabat.

16

See Mekki Bentahar, "Vie quotidienne banlieue marocain," in La vile et l’espace urbain, Bulletin économique et social du Maroc, nos. 147-148 (Rabat: SMER, 1981), p. 52.

17

Michael Pinseau, Evidentiary Report of the SDAU of Marrakech (Marrakech: Ministry of Interior, 1991), p. 20.

18

Ibid, p. 35.

19

These numbers are approximate in the sense that it is enormously difficult to arrive at an exact estimate of the number of constructed homes. On this matter, see a very interesting study that tried to evaluate critically the data-collecting system and the way results are analyzed relative to building permits. For the year 1994, this study achieved, on the one hand, an exhaustive census of building permits and, further, verified that registers of urban communes conformed to reality throughout a representative sample of chosen projects and research of construction sites. See the two-volume study by TEAM Morocco for Ministry of Housing, Direction of Building Promotion, Étude relative à la détermination des flux de production de logements et l’évaluation du système de collecte des données des autorisations de construire, 3d ed. (Rabat: Ministry of Housing, July 1996).

20

The population responds to this deficit in a number of ways, among them unauthorized construction, a high level of cohabitation among families, and increased numbers of persons per household.

21

SNEC = Société Nationale d'Équipment et de Construction; ANHI = Agence Nationale de Lutte contre l'Habitat Insalubre.

22

Given the source of financing for the 200,000-unit campaign and the very severe degree of conditionality of the CIH, the households that participated in the program came essentially from the private sector affiliated with the CNSS (Caisse Nationale de Sécurité Sociale), that is, the employees of the local collectivities and agents of the public administration.

23

Buyers must pay an advance to the selling entity of at least 30,000 Dhs. Further on we shall see that future buyers meet this condition only with difficulty and that it in fact causes many buyers to pull out.

24

See Mohammed Gheris, "Financement du logement et titrisation hypothécaire au Maroc," paper presented at the UNIMED-FORUM seminar, "Politique et coopération économique," November 29—December 3, 1999, Aix-en-Provence.

25

See Vie Économique (Casablanca), December 17, 1999, p. 17. The newspaper notes, "In analyzing the non-sales of certain ERACs, it can be confirmed that this total quantity contains homes that are part of the project to build 200,000 homes. In other words, housing, even social housing (costing not more than 200,000 Dhs), turns out to be difficult to buy."

26

See "Étude relative aux aspects financiers et fiscaux," Group Algoe-Promoconsult, on behalf of the Ministry of Housing, 1997.

27

See, later in this text, the discussion of developments devoted to the system of financing housing in Morocco.

28

The current financing situation of the OSTs, notably of the ERACs, is critical. Because of their excessive indebtedness to the CIH, they are all more or less unable to pay back the loans that have been contracted with the latter. CIH has therefore suspended all prefinancing for the OSTs until their financial situation has been stabilized.

29

Social housing is in fact also financed by the BCP (Banque Central Populaire), which also benefits (as has the CIH since 1998) from the the authorization of the public powers to finance social housing. This possibility is accorded to other commercial banks, but to date, none of them have shown an interest.

30

This percentage is valid for the years prior to 1998. Since then, in the face of the general decline of CIH's activity, this part has considerably regressed. It must also be emphasized that several commercial banks (such as Wafabank, and notably BCP) are increasingly interested in financing buildings, although entirely for luxury developments.

31

For example, the CIH has a monopoly on financing the project to build 200,000 units of housing.

32

Comparative studies concerning Moroccan banks have shown that the net banking profit of the CIH was for the most part higher than those of the other banks (in the mid-1990s).

33

Nearly three-quarters of ERAC-Tensift's activities have taken place within the city of Marrakech proper. For the latest figures, see ERAC's 1998 Activity Report, pp. 7, 26, and 32. The totals under construction since January 1999 consist of 1,182 housing units, 8,122 lots, 374 businesses, and the renovation of 2,265 units.

34

ERAC-Tensift's production, classified by type of product, consists of collective housing (11percent), individual homes (13 percent), and finally, a predominance of lots on which individual homes are to be built (58 percent).

35

See Vie Économique, December 17, 1999, p. 17. Under the heading of works that do not enter directly into ERAC-Tensift's competence, we must note that the latter enlarged National, Route 1 Marrakech-Agadir by 2.7 km (2 x 9 m) and completed corresponding renewal projects, as,well as, other works, with a total value of 11.3 million Dhs (in addition to a main sewer °tumid: the site of, renewal at a cost of 10 million Dhs).

36

See ERAC-Tensift's 1998 Activity Report, p. 11.

37

From our interviews with those responsible for urbanism in Marrakech and members of the Marrakech Urban Agency (l'Agence Urbaine de Marrakech), we learned of special dispensations accorded to ERAC-Tensift to enable the achievement of population densities and building heights that do not conform to the standards outlined in the city's urbanization charter.

38

Moreover, ERAC-Tensift recognizes that "the urgent nature of the program in terms of studies and projects launched has not been without negative repercussions on the regular progress of the construction sites and in terms of delays of execution." These remarks were made during a roundtable held on the social program of the HAM (district of Marrakech), ERAC-Tensift, July 2, 1999 (unpublished). It should also be noted that the urgent nature of the program led to the projects being launched without any synchronization with other ministries.

39

This study is not directly interested in the problems of prefinancing faced by promoters of the campaign for the 200,000 units of housing. Rather, we have focused on the problems of postfinancing (buyer credits).

40

Tontine is defined by Webster's as "an annuity scheme in which subscribers share a common fund with the benefit of survivorship, the survivors' shares being increased as the subscribers die, until the whole goes to the last survivor."

41

Most of those surveyed acknowledged that recourse to the system of pseudo-mortgaging over several years enabled them to amass some savings.

42

The archaic legislation concerning leasing of housing in Morocco discourages investment in this segment. Laxness on the part of the administration and the judicial authorities dissuades all property owners from renting their dwellings out of fear, quite simply, of losing them. It is for this reason that considerable guarantees (such as payment of several months' rent in advance) are required.

43

See Philippe Hugon, "Incertitude, précarité et financement local, le cas des économies africaines," Revue Tiers Monde (January—March 1996), p. 145.

44

Institutional savings, which, for example, represented 70,755 million Dhs in 1997 compared to 56,962 in 1995, does not exceed 20 percent of the total investments by nonfinancial institutions. In contrast, liquid advances and short-term investments exceed 75 percent of the investments by nonfinancial agents. (Source: Report from the Bank Al Maghrib, 1997.)